- Учителю

- Учебно-методическое пособие по учебной дисциплине «Английский язык» для студентов заочного отделения специальности 38.02.01 Экономика и бухгалтерский учет

Учебно-методическое пособие по учебной дисциплине «Английский язык» для студентов заочного отделения специальности 38.02.01 Экономика и бухгалтерский учет

Бюджетное учреждение профессионального образования

Ханты-Мансийского автономного округа - Югры

«Белоярский политехнический колледж»

Учебно-методическое пособие

по учебной дисциплине «Английский язык» для студентов заочного отделения

38.02.01 Экономика и бухгалтерский учет

Белоярский 2016

Кафедры иностранных языков

Составлена в соответствии с государственными требованиями к минимуму содержания и уровню подготовки выпускника специальности 38.02.01

Авторы: Боцвинова Е.А., старший преподаватель английского языка

1. Пояснительная записка

Учебно-методическое пособие предназначено для студентов экономических специальностей При составлении пособия, автором были учтены требования к зачету по английскому языку, состоящему из трех этапов:

- чтение оригинального текста (контроль точности и полноты понимания осуществляется посредством письменного перевода с использование словаря);

- грамматический перевод предложений с русского языка на английский), содержащих специализированную лексику;

- собеседование по материалам озвученных тем по специальности.

Часть 1 содержит тематический план по курсу «Английский язык» для студентов заочного отделения, описание структуры курса.

В части 2 пособия системно представлен комплекс контрольных заданий на 1, 2, 3 семестры. Каждый вариант контрольной работы состоит из трех частей. Условия выполнения задания традиционны , изложены в доступной форме и направлены на закрепление навыков работы с грамматическим и лексическим материалом (1-2 части). Третья часть работы включает адаптированные и оригинальные тексты по специальности. После заданий контрольных работ предлагаются методические указания знакомящие студента с требованиями кафедры к оформлению и выполнению контрольных работ, рекомендации к организации самостоятельной работы.

Часть 3 пособия состоит из грамматических заданий, которые могут использоваться в качестве тренировочных упражнений в ходе аудиторных занятий и предлагаться для самостоятельной работы по формировании. И совершенствованию навыков грамотного перевода с русского на английский, практическому применению знаний грамматических норм. С помощью предложенных заданий, студенты могут реально оценить свои знания во время индивидуальных консультаций, обнаружить и проанализировать типичные ошибки, тем самым, корректируя как теоретические знания, так и навыки их практического использования.

Заключительная часть пособия включает адаптированные и оригинальные тексты по экономическим проблемам.

Лексический материал текстов может широко использоваться при подготовке устных сообщений по темам специальностей.

Цель пособия - наиболее полно представить необходимый лексический и грамматический материал, тем самым, оказав необходимую помощь студентам в подготовке к зачетам и экзаменам.

Часть 1.

Тематический план по курсу «Английский язык»

(60 аудиторных часов)

Тема, подтемы

Кол-во часов

Грамматический материал

Часть 2.

Контрольные задания 1-3 семестры.

КОНТРОЛЬНАЯ РАБОТА № 1

Вариант № 1

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Учебное пособие: И.И. Воронцова "Английский язык для студентов экономических факультетов". Стр.4-8.

Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Артикль. Имя существительное. Множественное число существительных. Выражение падежных отношений. Притяжательный падеж. Времена группы Simple. Времена группы Perfect. Страдательный залог. Условные предложения.

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык

the government and local authorities; Finns experience high sales; their sales fall; total spending declines as income falls; luxury items; the high street banks suffered badly; to earn interest on loans; so-called "bad debts"

Задание № 2. Замените слова, выделенные курсивом синонимами

The economy comprises millions of people; losses were incurred; the nation has dealings; changes in the state of the economy affect all types of business; Profits declined; losses amounted to over £100 million.

Задание № 3. Образуйте однокоренные слова от "econom" и вставьте подходящие по смыслу слова вместо пропусков.

ics

ic

al

ly

ist

1. Marx and Keynes are two famous __.

2. Those people arc studying the science of __.

3. We sometimes call a person's work his __ activity.

4. People should be very __ with the money they earn.

5. The __ system of a country is usually called the national __.

6. The people in that town live very __. Translate into English

Задание № 4. Найдите в тексте английские эквиваленты следующих словосочетаний:

играть заметную роль; формировать среду; сокращать расходы на... ; сократить размеры прибыли; переживать подъем; переживать тяжелые времена; прийти в упадок; нести убытки; состояние экономики; иметь большое значение для бизнеса в целом; не выполнять обязательств по уплате.

Задание № 5. Вставьте вместо пропусков подходящие по смыслу слова

need, profitable, converts, filled, pitfalls, a gap, goals, reality

GOING INTO BUSINESS

Owning a business is the dream of many Americans. Starting that business … your dream into reality. But, there is … between your dream and … that can only be … with careful planning. As a business owner, you will … a plan to avoid …, to achieve your … and to build a … business.

Часть 2 Грамматика

Задание № 1. Образуйте из следующих фрагментов законченные предложения, включив в их состав один или несколько подходящих по смыслу глаголов - сказуемых.

-

The typewriter with the broken return key.

-

Our annual office party.

-

My new office.

-

The company in the building next door.

Задание № 2. Образуйте из следующих фрагментов законченные предложения, включив в каждый из них один или несколько подходящих по смыслу подлежащих.

-

edits the company newsletter.

-

types several letters each morning.

-

files each account executive's report.

-

process each claim.

Задание № 3. Раскройте скобки, поставьте глагол в правильную форму.

-

We (to sell) a variety of software.

-

She (to run) the branch office.

-

In the morning he (to listen) to the answering.

-

Every day we (to read) the office mail.

Задание № 4. Выберите правильные формы глагола.

-

The Internal Revenue Service ________ tax returns by 5 o'clock.

a) audit b) audited c) had audited

-

The committee ________ policy changes.

a) recommends b) is recommending c) has recommended

-

The manager ________ all promotions.

a) had approved b) approved c) is approving

Задание № 5. Напишите предложение в страдательном залоге.

-

The manager plans each meeting.

-

The computer operator enters the data.

-

Managers hire many people each year.

Задание № 6. Переведите предложения с русского на английский язык.

-

Если бы Вы повысили его в должности, он бы не уволился.

-

Если они позволят, сообщите им о собрании торговых представителей.

-

Если бы мы приняли на работу несколько машинисток, мы не испытывали бы сейчас такие трудности.

Часть 3

Прочитайте и переведите текст. Дайте письменный перевод 4 и 5 абзацев.

THE ECONOMIC ENVIRONMENT

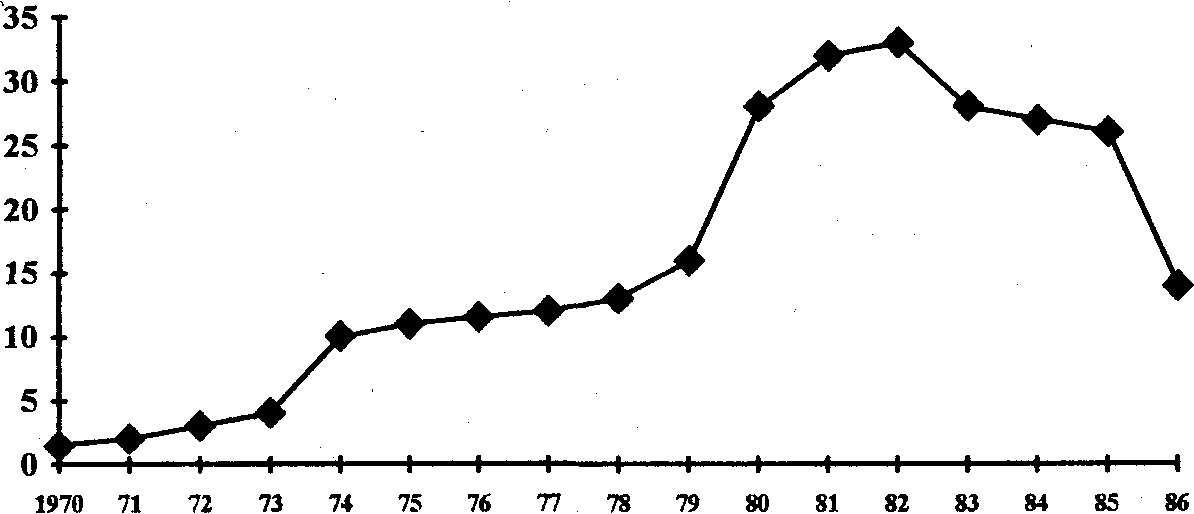

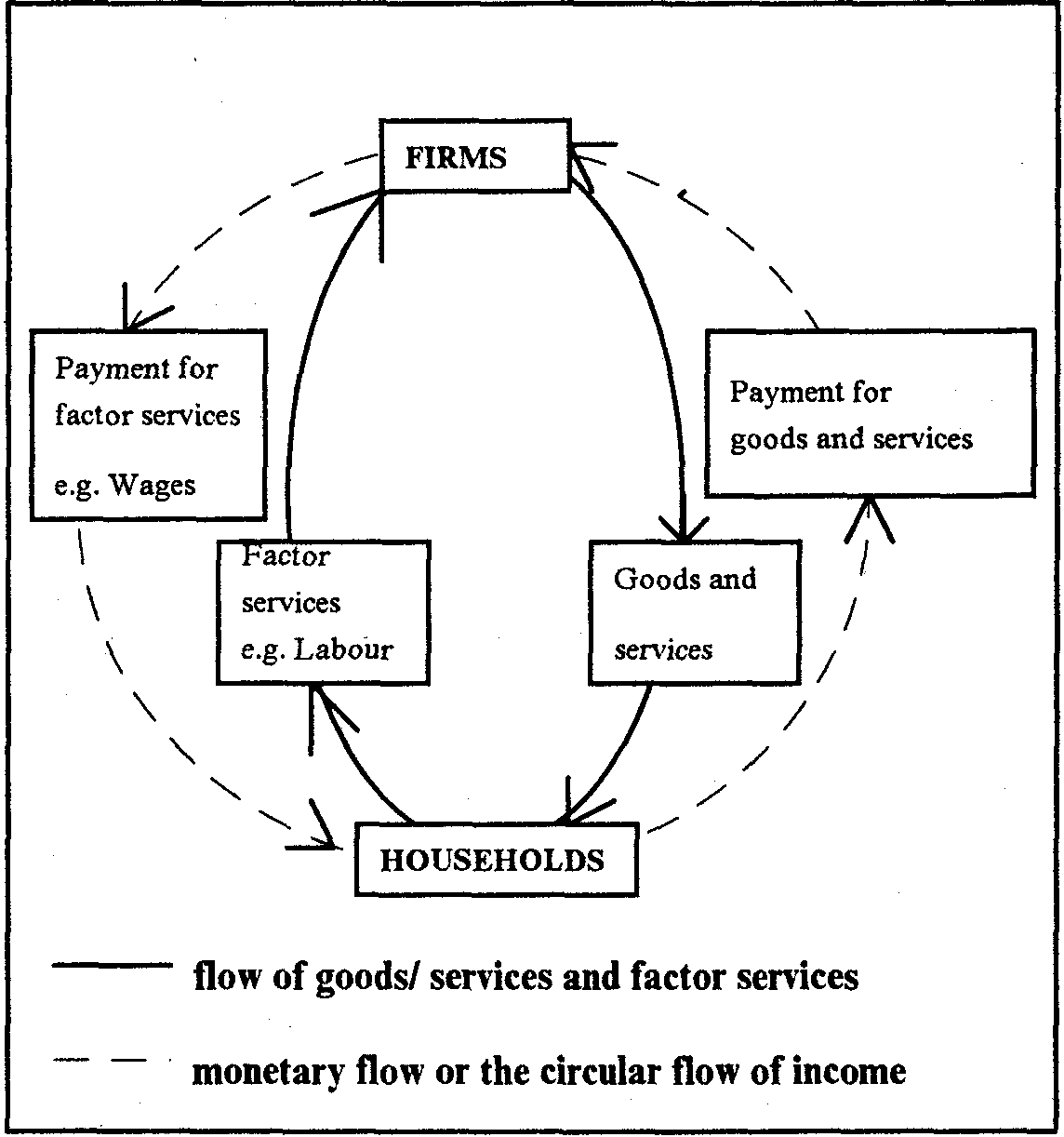

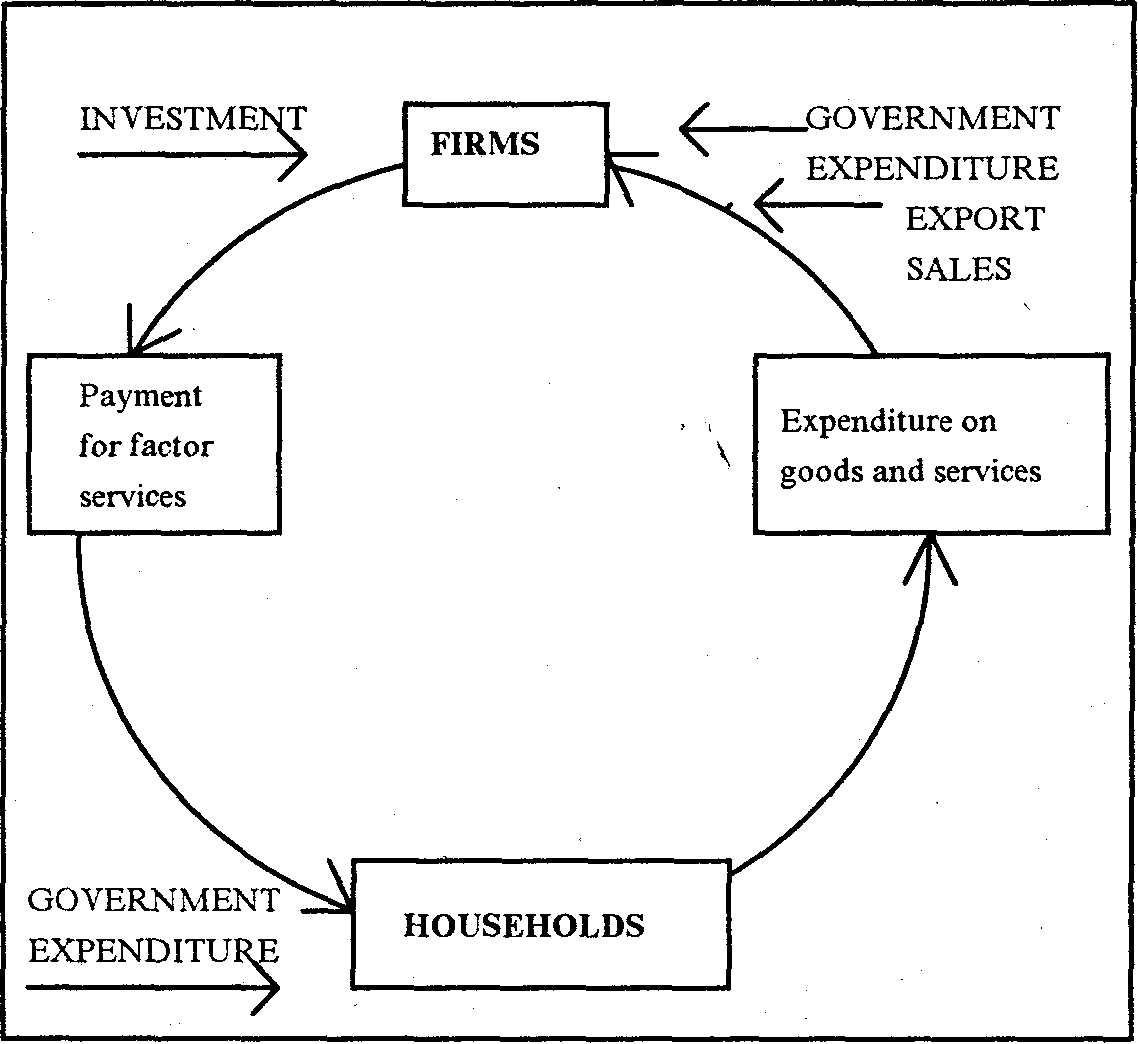

The economy comprises millions of people and thousands of firms as well as the government and local authorities, all taking decisions about prices and wages, what to buy, sell, produce, export, import and many other matters. All these organizations and the decisions they take play a prominent part in shaping the business environment in which firms exist and operate.

The economy is complicated and difficult to control and predict, but it is certainly important to all businesses. You should be aware that there are times when businesses and individuals have plenty of funds to spend and there are times when they have to cut back on their spending. This can have. enormous implications for business as a whole.

When the economy is enjoying a boom, firms experience high sales and general prosperity. At such times, unemployment is low and many firms will be investing funds to enable them to produce more. They do this because consumers have plenty of money to spend and firms expect high sales. It naturally follows that the state of the economy is a major factor in the success of firms.

However, during periods when people have less to spend many firms face hard times as their sales fall. Thus, the economic environment alters as the economy moves into a recession. At that time, total spending declines as income falls and unemployment rises. Consumers will purchase cheaper items and cut expenditure on luxury items such as televisions and cars.

Changes in the state of the economy affect all types of business, though the extent to which they are affected varies. In the recession of the early 1990s the high street banks suffered badly. Profits declined and, in some cases, losses were incurred. This was because fewer people borrowed money from banks, thus denying them the opportunity to earn interest on loans, and a rising proportion of those who did borrow defaulted on repayment. These so-called "bad debts' cut profit ">No individual firm has the ability to control tills aspect of its environment. Rather, it is the outcome of the actions of all the groups who make up society as well as being influenced by the actions of foreigners with whom the nation has dealings.

Answer the questions:

1. What does the economy comprise?

2. What's a boom in the economy? What characterises the state of the economy at that time?

3. What happens when the economy moves into a recession?

4. What are "bad debts"?

5. What happened to some banks in the early 1990s and why?

КОНТРОЛЬНАЯ РАБОТА № 1

Вариант № 2

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Учебное пособие: И.И. Воронцова "Английский язык для студентов экономических факультетов". Стр. 9-12.

Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Артикль. Имя существительное. Множественное число существительных. Выражение падежных отношений. Притяжательный падеж. Времена группы Simple. Времена группы Perfect. Страдательный залог. Условные предложения.

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык

a prime example; the adverse effects; householders; statistics are available to show; available resources of labour; at full capacity; key industries; key data; the value of a nation's output; the Treasury; building societies.

Задание № 2. Замените слова, выделенные курсивом синонимами

a large number of, the operation of the world's major economies; headlines relate to; the implications for individuals and businesses; by highlighting the adverse effects on businesses; these resources are being under-utilised; figures give an indicator of, changes have great significance for; numerous; additionally;

economic statistics are presented in many forms

Задание № 3. Образуйте однокоренные слова от "produc" и вставьте подходящие по смыслу слова вместо пропусков.

e

r

t

iv(e)

ity

ion

1. The company __ a new commodity every year.

2. The company's newest __ is a special blue soap powder.

3. The __ of soap powders met last year to discuss prices.

4. That factory is not as __ now as it was 5 years ago.

5. The __ of that factory has gone down over the last 5 years.

6. The manager of the factory has decided that they must increase their __ of packets of soap powder.

Задание № 4. Найдите в тексте английские эквиваленты следующих словосочетаний:

много (многочисленные); в этом отношении; средства массовой информации; подчеркивать, выделять; закладные; объем производства; сырье; не полностью используется; уровень занятости; валовой национальный продукт; опубликовать в каких-либо источниках

Задание № 5. Вставьте вместо пропусков подходящие по смыслу слова

washer, feasibility, crucial, fail, range, niche,

entrepreneurs, required for

FINDING A NICHE

Small business … in size from a manufacturer with many employees and millions of dollars in equipment to the lone window … with a bucket and a sponge. Obviously, the knowledge and skills … these two extremes are far apart, but for success, they have one thing in common - each has found a business … and is filling it.

The most … problems you will face in your early planning will be to find your niche and determine the … of your idea. "Get into the right business at the right time" is very good advice but following that advice may be difficult. Many … plunge into a business venture so blinded by the dream that they … to thoroughly evaluate its potential.

Часть 2 Грамматика

Задание № 1. Образуйте из следующих фрагментов законченные предложения, включив в их состав один или несколько подходящих по смыслу глаголов - сказуемых.

-

The empty file cabinet.

-

Four desks in the typing room.

-

The man with the briefcase.

-

Your former employer.

Задание № 2. Образуйте из следующих фрагментов законченные предложения, включив в каждый из них один или несколько подходящих по смыслу подлежащих.

-

collects the surveys from everyone in the office.

-

prepared the study for the committee.

-

take work home with them.

-

leaves the office every day.

Задание № 3. Раскройте скобки, поставьте глагол в правильную форму.

-

I (to prepare) a sales report four times a year.

-

It (to take) many dedicated people to run a company.

-

They (to type) the invoices for each customer.

-

She (to consider) several options before deciding.

Задание № 4. Выберите правильные формы глагола.

-

The personnel department ________ job applicants.

a) screens b) has been screening c) has screened

-

Bank tellers ________ thousand of dollars each day.

a) handle b) are handing c) have handled

-

The loan officer ________ credit references.

a) is checking b) checks c) has checked

Задание № 5. Напишите предложение в страдательном залоге.

-

Each of the representatives cover pert of the district.

-

The coordinator of the project schedules meetings.

-

Owners of the personal computers buy many kinds of software.

Задание № 6. Переведите предложения с русского на английский язык.

-

Если бы правление приняло решение, мы бы узнали об этом первыми.

-

Если бы г-н Кен уехал в Нью-Йорк сегодня, он бы успел на конференцию.

-

Если Ваши планы изменятся, позвоните мне.

Часть 3

Прочитайте и переведите текст. Дайте письменный перевод 2, 3, 4 абзацев.

MEASURING ECONOMIC ACTIVITY

There are a large number of statistics produced regularly on the operation of the world's major economies. The UK's economy is no exception in this respect. You will probably have noticed that often the headlines in newspapers or important items on television news programmes relate to economic data and the implications for individuals and businesses. A prime example of this occurs when interest rates are increased: the media responds by highlighting the adverse effects on businesses with debts and householders with mortgages.

Data is provided on a wide range of aspects of the economy's operation. Statistics are available to show.

-

the level of unemployment

-

the level of inflation

-

a country's trade balance with the rest of the world

-

production volumes in key industries and the economy as a whole

-

the level of wages

-

raw material prices, and so forth.

The main statistics illustrating the economy's behaviour relate to the level of activity in the economy. That is, they tell us whether the economy is working at fall capacity using all or nearly all, available resources of labour, machinery and other factors of production or whether these resources are being under-utilized.

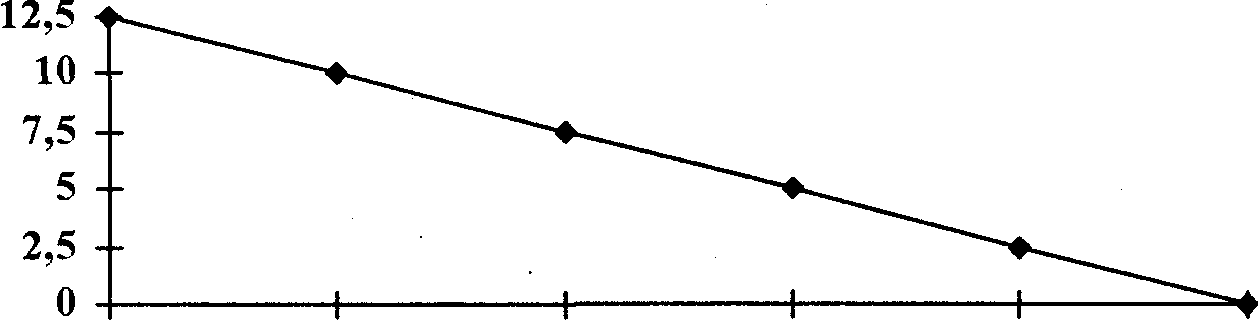

The unemployment figures for the economy give an indicator of the level of activity. As the .economy moves towards a recession and a lower level of prosperity it is likely that unemployment figures will rise. An alternative measure of the level of activity is national income statistics, which show the value of a nation's output during a year. Economists use the term Gross National Product to describe this data. Changes in the level or trends of such key data have great significance for businesses, as we shall see later.

There are numerous sources of data on the economy of which we can make use. The government publishes much through the Treasury, Department of Trade and Industry, the Bank of England and the Department of Employment. The Central Statistical Office, which was established during the Second World War, publishes about half of the government's economic data.

Much of this is contained in its annual publication, "The Annual Abstract of Statistics". It also publishes the equally valuable "Social Trends" annually. Additionally, private organizations, such as the banks, building societies and universities, publish figures on various aspects of the economy's performance.

Economic statistics are presented in many forms, the most common being graphs and tables. Although these statistics can be valuable in assisting managers, they should be treated with some caution when predicting the future trend of the economy and thus helping the business to take effective decisions.

Answer the questions:

1. Why does the media relate to economic data and the implications for individuals and businesses?

2. What aspects of the economy's operation are statistics available to show?

3. What do statistics show?

4. What are the sources of data on the economy in the UK? In Russia?

5. What is the GNP?

6. Why should statistics be treated with some caution?

КОНТРОЛЬНАЯ РАБОТА № 1

Вариант № 3

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Учебное пособие: И.И. Воронцова "Английский язык для студентов экономических факультетов". Стр. 21-24.

Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Артикль. Имя существительное. Множественное число существительных. Выражение падежных отношений. Притяжательный падеж. Времена группы Simple. Времена группы Perfect. Страдательный залог. Условные предложения.

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык

income is shared around; income doesn't just cover the necessities of life; to suggest an answer to the question; to direct the production towards the goods and services; individual governments

Задание № 2. Вставьте вместо пропусков подходящие по смыслу слова

1. You have __, that is what you earn in a year.

2. Your income doesn't just __ the necessities of life.

3. It includes __, whether that's sport or TV or a holiday.

4. __ is the sum total of the incomes of all the people living in that country.

Задание № 3. Найдите английские эквиваленты следующих словосочетаний:

распределение доходов; ежегодный доход; определенный уровень жизни; национальный доход; мировой доход; доля национального дохода; доход на душу населения; процент мирового населения; страны со средним уровнем дохода; неравное распределение доходов.

Задание № 4. Вставьте вместо пропусков подходящие по смыслу слова

statistician, capturing, owner, gather, effort, determine,

investing, analyse

MARKET ANALYSIS

For small business to be successful, the … must know the market. To learn the market, you must … it, a process that takes time and …. . You don't have to be a trained … to analyse the market place nor does the analysis have to be costly.

Analysing the market is a way to … facts about potential customers and to … the demand for your product or service. The more information you gather, the greater your chances of … a segment of the market. Know the market before … your time and money in any business venture.

Часть 2 Грамматика

Задание № 1. Образуйте из следующих фрагментов законченные предложения, включив в их состав один или несколько подходящих по смыслу глаголов - сказуемых.

-

The important letter.

-

A large order from Japan.

-

The store at the corner.

-

The insurance agency.

Задание № 2. Образуйте из следующих фрагментов законченные предложения, включив в каждый из них один или несколько подходящих по смыслу подлежащих.

-

reads the Wall Street Journal.

-

travel to New York often.

-

prepares income tax returns.

-

programs the computer.

Задание № 3. Раскройте скобки, поставьте глагол в правильную форму.

-

He (to hire) several new employees each year.

-

She (to study) each proposal carefully.

-

The clerks (to file) the deeds.

-

The secretary (to type) all of our correspondence.

Задание № 4. Выберите правильные формы глагола.

-

Our training manuals ________ the latest information.

a) contains b) containing c) contain

-

Interoffice memos ________ valuable time.

a) are saving b) have saved c) save

-

The insurance agency ________ just each claim.

a) process b) has processed c) processed

Задание № 5. Напишите предложение в страдательном залоге.

-

The auditor from the finance department audits the books.

-

The editor in the acquisitions department edits manuscripts.

-

The board of governors sets the agenda.

Задание № 6. Переведите предложения с русского на английский язык.

-

Если бы наш отдел купил новый компьютер, у нас бы не было проблем.

-

Если Вы напечатаете это письмо сразу, я буду Вам очень благодарен.

-

Если Вы примите решение, позвоните нам.

Часть 3

Прочитайте и переведите текст. Дайте письменный перевод 2 и 3 абзацев.

INCOME

The second of the three economic issues is the question of income, that is, income distribution, the way in which income - that's what people earn - is distributed or Shared around.

You, and your family, have an income. You have an annual income, that is what you earn in a year. This income allows you to enjoy various goods and services. It means you have a certain standard of living. Your standard of living, of course, includes what you think of as necessary to your life, things like food, water, somewhere to live, health and education. But your income doesn't just cover the necessities of life. It also includes recreation, whether that's sport or TV or a holiday. Your income will be less than some of your neighbours', but it will be more than some of your other neighbours'. Your neighbours mean not just people living in your own country, but also people living in other countries.

Just as you and your family have an income, so nations, different countries, also have an income - the national income, it's often called. A national income is not the money the government gets. The national income is the sum total of the incomes of all the people living in that country, in other words, everyone's income added together. In the same way one can think of world income as the total of all the incomes earned by all the people in the world.

Concerning the distribution of national and world income, some questions are to be asked: who, in the world, gets what share of these incomer The distribution of income, either in the world or in a country, tells us how income is divided between different groups or individuals. Table 1 shows the distribution of world income. There are three headings down the left-hand side of the table: income per head, percentage of world population and percentage of world income. In poor countries, like India, China and the Sudan, the income per head is only one hundred and fifty-five pounds per year. But at the same time, they have fifty point seven per cent of the world's population. These poor countries only have five per cent of the world's income.

In middle-income countries the income per head is eight hundred and forty pounds, that's in countries like Thailand and Brazil. In the major oil countries, like Kuwait and Saudi Arabia, it's seven thousand, six hundred and seventy. In industrial countries it's six thousand, two hundred and seventy.

Turning to middle-income countries again, they have twenty-five point one per cent of world population, with fourteen point two per cent of world income. The major oil countries have point four per cent of population, the industrial countries fifteen point six. The oil countries have one point five per cent of world income, the industrial countries sixty-four point eight.

The first economic question is for whom does the world economy produce? As the table shows, it produces essentially for the people living in the rich industrial countries. They get sixty per cent of the world's income, although they only have sixteen per cent of its population. This suggests an answer to the second question, that is of what is produced. The answer is that most of world production will be directed towards the goods and services that these same rich industrialised countries want.

The third question is haw goods are produced. In poor countries, with little machinery, not very much technical training and so on, workers produce much less than workers in rich countries. And poverty is very difficult to escape. It continues on and on. And this goes some way towards accounting for the differences in national incomes. It accounts for an unequal distribution of income, not just between countries but also between members of the same country, although there individual governments can help through taxation. In other words, governments can act to help distribute income throughout their population.

Заполнить таблицу сведениями из текста

Table 1. The distribution of world income

Poor countries

Middle-income countries

Major oil countries

Industrial countries

Soviet bloc

Income per head

% of world

population %

of world

income

КОНТРОЛЬНАЯ РАБОТА

Вариант № 4

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Учебное пособие: И.И. Воронцова "Английский язык для студентов экономических факультетов". Стр. 34-37.

Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Артикль. Имя существительное. Множественное число существительных. Выражение падежных отношений. Притяжательный падеж. Времена группы Simple. Времена группы Perfect. Страдательный залог. Условные предложения.

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык

ach factory is set a production target to meet; to divert resources to wherever it wants; new ideas rarely come forward; tend to be slow when responding to changes

Задание № 2. Замените слова, выделенные курсивом синонимами

obsolete products; it can ensure that...; it can. be very inefficient

There is no incentive for individuals to work hard in planned economies.

It led to many nations abandoning planned economies over recent years.

Задание № 3. Вставьте вместо пропусков подходящие по смыслу слова

1. An economic system is the way in which a country uses its __ to satisfy the demands of__ for goods and services.

2. The actual system employed planned economies have __.

3. There is no __ for individuals to work hard in planned economies.

4. Planners are likely __ some items as they cannot __ changes in demand.

Задание № 4. Найдите английские эквиваленты следующих словосочетаний:

имеющиеся в распоряжении ресурсы; управлять использованием ресурсов; управление экономикой; отказываться от плановой экономики; иметь высокий жизненный уровень; иметь общие черты; полученная прибыль; реагировать на изменения спроса.

Задание № 5. Вставьте вместо пропусков подходящие по смыслу слова

entrepreneurs, fail, sufficient, funds, reasons, dilemma,

operate

FINANCES

A large number of small businesses ... each year. There are a number of … for these failures, but one of the main reasons is insufficient … . Too many … try to start-up and … a business without … capital (money). To avoid this … , you can review your situation by analyzing these three questions.

-

How much money do you have?

-

How much money will you need to start your business?

-

How much money will you need to stay in business?

Часть 2 Грамматика

Задание № 1. Образуйте из следующих фрагментов законченные предложения, включив в их состав один или несколько подходящих по смыслу глаголов - сказуемых.

-

The man next door.

-

The new sales representative.

-

The department's manager.

-

The expensive computer system.

Задание № 2. Образуйте из следующих фрагментов законченные предложения, включив в каждый из них один или несколько подходящих по смыслу подлежащих.

-

runs for office.

-

sorts the office mail.

-

sells the most cars.

-

drive to work every day.

Задание № 3. Раскройте скобки, поставьте глагол в правильную форму.

-

He always (to check) the bulletin board for messages.

-

I (to like) taking the train to work.

-

He often (to enter) the figures into the computer.

-

They (to review) the budget every quarter.

Задание № 4. Выберите правильные формы глагола.

-

Accountants ________ our books every year.

a) review b) have reviewed c) are reviewing

-

Last morning the editor ________ each manuscript.

a) had revised b) revised c) had been revising

-

Recently trainees ________ three hours of instruction with the new software.

a) received b) receive c) had received

Задание № 5. Напишите предложение в страдательном залоге.

-

The leader of the group makes the decision.

-

This organization gathers the managers from various districts for a meeting once a year.

-

The representative in our office oversees the department.

Задание № 6. Переведите предложения с русского на английский язык.

-

Если бы управляющий принял на работу курьера, мы могли бы не испытывать трудностей.

-

Если Вы увидите торговых представителей на заседании, попросите их зайти ко мне в кабинет.

-

Если бы у меня было сейчас хоть немного свободного времени, я бы помог Вам.

Часть 3

Прочитайте и переведите текст. Дайте письменный перевод 6, 7, 8 абзацев.

ECONOMIC SYSTEMS

There are a number of ways in which a government can organize its economy and the type of system chosen is critical in shaping environment in which businesses operate.

An economic system is quite simply the way in which a country uses its available resources (land, workers, natural resources, machinery etc.) to satisfy the demands of its inhabitants for goods and services. The more goods and services that can be produced from these limited resources, the higher the standard of living enjoyed by the country's citizens.

There are three main economic systems: planed economics, market economics, mixed economics.

Planned economics (Плановая экономика)

Planned economies are sometimes called "command economies" because the state commands the use of resources (such as labour and factories) that are used to produce goods and services as it owns factories, land and natural resources. Planned economies are economies with a large amount of central planning and direction, when the government takes all the decisions, the government decides production and consumption. Planning of this kind is obviously very difficult, very complicated to do, and the result is that there is no society, which is completely a command economy. The actual system employed varies from state to state, but command or planned economies have a number of common features.

Firstly, the state decides precisely what the nation is to produce. It usually plans five years ahead. It is the intention of the planners that there should be enough goods and services for all.

Secondly, industries are asked to comply with these plans and each industry and factory is set a production target to meet. If each factory and farm meets its target, then the state will meet its targets as set out in the five-year plans. You could think of the factory and farm targets to be objectives which, if met, allow the nation's overall aim to be reached.

A planned economy is simple to understand but not simple to operate. It does, however, have a number of advantages:

-

Everyone in society receives enough goods and services to enjoy a basic standard of living.

-

Nations do not waste resources duplicating production.

-

The state can use its control of the economy to divert resources to wherever it wants. As a result, it can ensure that everyone receives a good education, proper health care or that transport is available.

Several disadvantages also exist. It is these disadvantages that have led to many nations abandoning planned economies over recent years:

-

There is no incentive for individuals to work hard in planned economies.

-

Any profits that are made are paid to the government.

-

Citizens cannot start their own businesses and so new ideas rarely come forward.

-

As a result, industries in planned economies can be very inefficient. A major problem faced by command or planned economies is that of deciding what to produce. Command economies tend to be slow when responding to changes in people's tastes and fashions. Planners are likely to under produce some items as they cannot predict changes in demand. Equally, some products, which consumers regard as obsolete and unattractive, may be overproduced. Planners are afraid to produce goods and services unless they are sure substantial amounts will be purchased. This leads to delays and queues for some products.

Answer the questions:

1. What's an economic system?

2. What does a standard of living depend on?

3. What's a planned economy? What are its main features?

4. Give the advantages of a planned economy.

5. Give the disadvantages of a planned economy.

КОНТРОЛЬНАЯ РАБОТА

Вариант № 5

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов". Стр. 37 - 41

Грамматика: Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Модальные глаголы. Инфинитив. Образование форм инфинитива. Функции инфинитива. Оборот "объектный падеж с инфинитивом", " именительный падеж с инфинитивом", "For + сущ. (местоимение) + инфинитив".

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык.

New advanced products; products which are favoured; provide free or subsidized supplies; produce goods and then advertise heavily; a decline in the prosperity of the nation.

Задание № 2. Замените слова, выделенные курсивом синонимами.

Business owned and run by the state; products and services which are favoured ;at first view ; production alters swiftly.

Задание № 3. Найдите в тексте английские эквиваленты следующих словосочетаний.

Управление экономикой ; процветание нации ; принимать законы ; быстро меняться ; конкурирующие фирмы ; частные фирмы ; сокращать производство ; дорого платить за что-либо.

Задание № 4. Вставьте вместо пропусков подходящие по смыслу слова.

Переписка по вопросам рекламы.

information placing readership opportunity reply advertisements

offered advertising

Dear Sirs,

In your letter of 23rd January, this year, you ……….us your services in ……… our clients' advertisements in magazines published in France.

Our clients welcome the ……… and should be glad to have full ………. about the magazines in which you intend to place their ……….. . In particular they want to know the …………, circulation and one-time ……….. rates.

A prompt ………will be appreciated.

Yours faithfully.

Часть 2 Грамматика

Задание № 1. Вставьте вместо пропусков модальные глаголы. Предложения переведите на русский язык.

-

I …… easily carry this trunk to the station.

a) can b) have to c) may

-

He said that he was not in the hall but he……… be in his study.

a) must b) might c) may

-

He said that he……… ship the goods in September.

a) has to b) could c) is to

Задание № 2. Переведите предложения с русского на английский язык.

-

Мне пришлось остаться дома вчера, так как у меня было очень много работы.

-

Делегация должна прибыть завтра.

-

Вам не следует брать кредит сейчас.

Задание № 3. Напишите следующие предложения в прошедшем и будущем времени.

-

We can offer you advertising materials and technical specifications.

-

They must be at the meeting at 5 p. m.

Задание № 4. Переведите следующие предложения на русский язык. Определите формы и функции инфинитива.

-

Procter & Gamble's controversial move to buy up shares from Novomoskovskbytkhim has attracted strong criticism.

-

It will give them control over the company, not to develop production but to eliminate all competition in the Russian market.

Задание № 5. Переведите следующие предложения на английский язык.

-

Никто не хочет, чтобы собрание откладывали.

-

Необходимо, чтобы документы были отосланы сегодня.

-

Говорят, что он очень опытный менеджер.

4. Он приказал секретарю тщательно проверить документы .

Часть 3.

Прочитайте и переведите текст. Дайте письменный перевод отмеченных абзацев.

ECONOMIC SYSTEMS

There are a number of ways in which a government can organize its economy and the type of system chosen is critical in shaping environment in which businesses operate.

An economic system is quite simply the way in which a country uses its available resources (land, workers, natural resources, machinery etc.) to satisfy the demands of its inhabitants for goods and services. The more goods and services that can be produced from these limited resources, the higher the standard of living enjoyed by the country's citizens.

There are three main economic systems: planed economics, market economics, mixed economics.

Market economics

The best examples of this type of economy are to be found in small South-East Asian states like Hong Kong and Singapore, though even they are not pure examples of market economies. Even they contain some businesses owned and run by the state.

In a true market economy the government plays no role in the management of the economy, the government does not intervene in it. The system is based on private enterprise with private ownership of the means of production and private supplies of capital, which can be defined as surplus income available for Investment in new business activities. Workers are paid wages by employers according to how skilled they are and how many firms wish to employ them. They spend their wages on the products and services they need. Consumers are willing to spend more on products and services, which are favoured. Firms producing these goods will make more profits and this will persuade more firms to produce these particular goods rather than less favoured ones.

Thus, we can see that in a market economy it is consumers who decide what is to be produced. Consumers will be willing to pay high prices for products they particularly desire. Firms, which are privately owned, see the opportunity of increased profits and produce the new fashionable and favoured products.

Such a system is, at first view, very attractive. The economy adjusts automatically to meet changing demands. No planners have to be employed, which allows more resources to be available for production. Firms tend to be highly competitive in such an environment. New advanced products and low prices are good ways to increase sales and profits. Since all firms are privately owned they try to make the largest profits possible. In a free market individual people are free to pursue their own Interests. They can become millionaires, for ^example. Suppose you invent a new kind of car. You want to make money out of it in your own interests. But when you have that car produced, you are in fact moving the production possibility frontier outwards. You actually make the society better-off by creating new jobs and opportunities, even though you become a millionaire in the process, and you do it without any government help or intervention.

Not surprisingly there are also problems. Some goods would be under purchased if the government did not provide free or subsidised supplies. Examples of this type of good and service are health and education. There arc other goods and services, such as defence and policing, that are impossible to supply individually in response to consumer spending. Once defence or a police force is supplied to a country then everyone in this country benefits.

A cornerstone of the market system is that production alters swiftly to meet changing demands. These swift changes can, however, have serious consequences. Imagine a firm, which switches from labour-intensive production to one where new technology is employed in the factory. The resulting unemployment could lead to social as well as economic problems.

In a market economy there might be minimal control on working conditions and safety standards concerning products and services. It is necessary to have large-scale government intervention to pass laws to protect consumers and workers.

Some firms produce goods and then advertise heavily to gain sufficient sales. Besides wasting resources on advertising, firms may also duplicate one another's services. Rival firms, providing rail services, for example, could mean that two or more systems of rail are laid.

Finally, firms have to have confidence in future sales if they are to produce new goods and services. At certain times they tend to lack confidence and cut back on production and the development of new ideas. This decision, when taken by many firms, can lead to a recession. A recession means less spending, fewer jobs and a decline in the prosperity of the nation.

Answer the questions:

1. What's a market economy?

2. What's the main difference between a market economy arid a planned economy?

3. Do changing demands affect production? In what way?

4. What's the mechanism of producing goods and services in a market economy?

КОНТРОЛЬНАЯ РАБОТА

Вариант № 6

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов". Стр. 41 - 44.

Грамматика: Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Модальные глаголы. Инфинитив. Образование форм инфинитива. Функции инфинитива. Оборот "объектный падеж с инфинитивом", " именительный падеж с инфинитивом", "For + сущ. (местоимение) + инфинитив".

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык.

An intermediate system has developed; to supply essential items ; the government controls a share of the output.

Задание № 2. Замените слова, выделенные курсивом синонимами.

Significant faults; a range of products; whilst others are used in response to the demands of consumers.

Задание № 3. Найдите в тексте английские эквиваленты следующих словосочетаний.

Избегать недостатков; частный сектор; налогообложение; централизованно принимать экономические решения; пользоваться благами.

Задание № 4. Вставьте вместо пропусков подходящие по смыслу слова.

Переписка по вопросам страхованияdelivered indemnified suggested risks discuss draw terms

Dear Sirs,

We have received your letter of March 3, this year, in which you ask us to change the …….. of insurance of equipment, ………… by us in the draft contract for the delivery of the equipment for the machinebuilding plant. You suggest that contract should provide insurance of the equipment against any kinds of ……. .

We …… your attention to the fact that Ingosstrakh does not insure equipment ………. to your ports against any kinds of risks. We know that insurance against different kinds of risks can be done with the LONDON INSURANCE COMPANY.

As to insurance against definite risks losses are …………. depending on the term of an insurance contract.

We are ready to ……. once again the terms or insurance.

Yours faithfully.

Часть 2 Грамматика

Задание № 1. Вставьте вместо пропусков модальные глаголы. Предложения переведите на русский язык.

-

Such defects…… easily lead to a serious breakdown of the machine.

a) must b) may c) can

-

Why did you stop at a hotel? You……. have spent the night at my home.

a) may b) could c)can

-

The expert pointed out that the goods…….. already have been in a bad condition at the time of dispatch.

a) can b) must c) may

Задание № 2. Переведите предложения с русского на английский язык.

-

Нам придется проверить счета еще раз.

-

Пароход должен был придти в Одессу 15 сентября, но из-за шторма он вынужден был зайти в Новороссийск и поэтому прибыл в Одессу на два дня позже.

-

Этот вопрос следовало обсудить на прошлом собрании.

Задание № 3. Напишите следующие предложения в прошедшем и будущем времени.

-

They can't fulfill terms of the contract.

-

We must walk fast to get to the station in time.

Задание № 4. Переведите следующие предложения на русский язык. Определите формы и функции инфинитива.

-

The town will go into decline, there will be less competition to help raise standards.

-

This "instruction into the Russian market" may have to be fought by the company's lawyers whom the federation will support in order to protect the interests of the workers.

Задание № 5. Переведите следующие предложения на английский язык.

-

Я хочу, чтобы вы отправили факс сейчас.

-

Нам очень трудно получить эти сведения.

-

Сообщают, что фирма С & D разорилась.

-

Представитель фирмы просил послать документы электронной почтой.

Часть 3.

Прочитайте и переведите текст. Дайте письменный перевод отмеченных абзацев.

Письменно ответьте на вопросы.

ECONOMIC SYSTEMS

There are a number of ways in which a government can organize its economy and the type of system chosen is critical in shaping environment in which businesses operate.

An economic system is quite simply the way in which a country uses its available resources (land, workers, natural resources, machinery etc.) to satisfy the demands of its inhabitants for goods and services. The more goods and services that can be produced from these limited resources, the higher the standard of living enjoyed by the country's citizens.

There are three main economic systems: planed economics, market economics, mixed economics.

Mixed economics

Command and market economies both have significant faults. Partly because of this, an intermediate system has developed, known as mixed economies.

A mixed economy means very much what it says as it contains elements of both market and planned economies. At one extreme we have a command economy, which does not allow individuals to make economic decisions, at the other extreme we have a free market, where individuals exercise considerable economic freedom of choice without any government restrictions. Between these two extremes lies a mixed economy. In mixed economies some resources are controlled by the government whilst others are used in response to the demands of consumers.

Technically, all the economies of the world are mixed: it is just the balance elements between market and planned elements that alters. Some countries are nearer to command economies, while others are closer to free market economies. So, for example. Hong Kong has some state-controlled industry, while Cuba has some privately owned and controlled firms.

The aim of mixed economies is to avoid the disadvantages of both systems while enjoying the benefits that they both offer. So, in a mixed economy the government and the private sector Interact in solving economic problems. The state controls the share of the output through taxation and transfer payments and intervenes to supply essential items such as health, education and defence, while private firms produce cars, furniture, electrical items and similar, less essential products.

The UK is a mixed economy: some services are provided by the state (for example, health care and defence) whilst a range of privately owned businesses offers other goods and services. The Conservative government under Margaret Thatcher switched many businesses from being state-owned and controlled to being privately owned as part of its privatisation programme. This has taken the UK economy further away from the planned system.

Answer the questions:

1. Are there really pure examples of planned and market economies in the world?

2. What's a mixed economy? What's its aim?

3. What type of economy is the UK? Is Russia now?

КОНТРОЛЬНАЯ РАБОТА

Вариант № 7

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов". Стр. 44 -49.

Грамматика: Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Модальные глаголы. Инфинитив. Образование форм инфинитива. Функции инфинитива. Оборот "объектный падеж с инфинитивом", " именительный падеж с инфинитивом", "For + сущ. (местоимение) + инфинитив".

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык.

1. a single living entity with a single conscious mind ; a shorthand expression ; to be reconciled by adjustment of smth ; a suitable part - time job; to offer high wages.

Задание № 2. Замените слова, выделенные курсивом синонимами.

at a distance; of the neighbourhood; carried out ; buy ; managing ; put up .

Задание № 3. Найдите в тексте английские эквиваленты следующих словосочетаний.

Поведение рынка; рынок ценных бумаг; проводить сделку; прибыльно продавать; неквалифицированная работа ; распределять ресурсы посредством системы цен.

Задание № 4. Вставьте вместо пропусков подходящие по смыслу слова.

Переписка по вопросам медицинского обслуживания

Dear Sirs,

In your letter of 15 July, this year, you write that our …….as Contractor will include ………….all personnel on the construction site with medical services.

In view of this we would like to …….the matter up as follows.

We are prepared to provide all personnel on the construction site, including local labour, with first aid. For this we will …………a first - aid dispensary at the construction site staffed with the required personnel and ……….with modern facilities.

As to medical treatment of Russian specialists and their dependents we believe that all………., including the cost of medicines and hospitalization expenses should be borne by the Customer.

We look ………to your letter confirming these point.

Yours faithfully.

Часть 2 Грамматика

Задание № 1. Вставьте вместо пропусков модальные глаголы. Предложения переведите на русский язык.

-

The expert admits that the goods…….. have been damaged in transit.

a) could b) may c) can

-

I said that the manager…….. not have missed the train.

a) must b) could c) may

-

The goods were packed in strong boxes so that they……. withstand oversea transport.

a) have to b) might c) must

Задание № 2. Переведите предложения с русского на английский язык.

-

Эти документы следовало послать в министерство вчера.

-

Согласно контракту, товары должны быть доставлены не позже 1 сентября.

-

Я должен был закончить эту работу вчера, но не смог этого сделать. Мне придется закончить ее сегодня.

Задание № 3. Напишите следующие предложения в прошедшем и будущем времени.

-

We can discuss terms of payment.

-

Our department must work out a new project.

Задание № 4. Переведите следующие предложения на русский язык. Определите формы и функции инфинитива.

-

We are implementing a $ 50 million investment programme in order to modernize and expand production.

-

Russian companies are hard pushed to compete with the experience, quality and standard of service demonstrated by their western counterparts.

Задание № 5. Переведите следующие предложения на английский язык.

-

Мы хотим, чтобы вы сообщили нам свои условия.

-

Вам необходимо быть здесь завтра в 5 часов вечера.

-

Вероятно, компания нашла нового дистрибьютора.

-

Они попросили сообщить им о прибытии груза.

Часть 3.

Прочитайте и переведите текст. Выполните письменный перевод отмеченных абзацев.

Письменно ответьте на вопросы

MARKETS

The Role of Market

Reports in the press tend to say "the market did this" or "the market expected good news on the economic front", as if the market were a single living entity with a single, conscious mind. This is not, of course, the case. To understand reports of market behaviour you have to bear in mind the way the market works.

A market is simply a mechanism, which allows individuals or organizations to trade with each other. Markets bring together buyers and sellers of goods and services. In some cases, such as a local fruit stall, buyers and sellers meet physically. In other cases, such as the stock market, business can be transacted over the telephone, almost by remote control. There's no need to go info these details. Instead, we use a general definition of markets.

A market is a shorthand expression for the process by which households' decisions about consumption of alternative goods, firms' decisions about what and how to produce, and workers' decisions about how much and for whom to work are all reconciled by adjustment of prices.

Prices of goods and of resources, such as labour, machinery and land, adjust to ensure that scarce resources are used to produce those goods and services that society demands.

Much of economics is devoted to the study of how markets and prices enable society to solve the problems of what, how and for whom to produce. Suppose you buy a hamburger for your lunch. What does this have to do with markets and prices? You chose the cafe because it was fast, convenient and cheap. Given your desire to eat, and your limited resources, the low hamburger price told you that this was a good way to satisfy your appetite. You probably prefer steak but that is more expensive. The price of steak is high enough to ensure that society answers the "for whom" question about lunchtime steaks in favour of someone else.

Now think about the seller's viewpoint. The cafe owner is in business because, given the price of hamburger meat, the rent and the wages that must be paid, it is still possible to sell hamburgers at a profit. If rents were higher, it might be more profitable to sell hamburgers in a cheaper area or to switch to luxury lunches for rich executives on expense accounts. The student behind the counter is working there because it is a suitable part-time job, which pays a bit of money. If the wage were much lower it would hardly be worth working at all. Conversely, the job is unskilled and there are plenty of students looking for such work, so owners of cafes do not have to offer very high wages.

Prices are guiding your decision to buy a hamburger, the owner's decision to sell hamburgers, and the student's decision to take the job. Society is allocating resources - meat, buildings, and labour - into hamburger production through the price system. If nobody liked hamburger's, the owner could not sell enough at a price that covered the cost of running the cafe and society would devote no resources to hamburger production. People's desire to eat hamburgers guides resources into hamburger production. However, if cattle contracted a disease, thereby reducing the economy's ability to produce meat products, competition to purchase more scarce supplies of beef would bid up the price of beef, hamburger producers would be forced to raise prices, and consumers would buy more cheese sandwiches for lunch. Adjustments in prices would encourage society to reallocate resources to reflect the increased scarcity of cattle.

There were several markets involved in your purchase of a hamburger. You and the cafe owner were part of the market for lunches. The student behind the counter was part of the local labour market. The cafe owner was part of the local wholesale meat market and the local market for rented buildings. These descriptions of markets are not very precise. Were you part of the market for lunches, the market for prepared food or the market for sandwiches to which you would have turned if hamburgers had been more expensive? That is why we have adopted a very general definition of markets, which emphasizes that they are arrangements through, which prices influence the allocation of scarce resources.

Answer the questions:

1. What example is given of a market where sellers and buyers actually meet?

2. How are households' decisions on what to buy reconciled?

3. Why do prices adjust?

4. What problems do markets and prices solve for society?

КОНТРОЛЬНАЯ РАБОТА

Вариант 8

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов". Стр. 85 -88.

Грамматика: Учебник по грамматике: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: Модальные глаголы. Инфинитив. Образование форм инфинитива. Функции инфинитива. Оборот "объектный падеж с инфинитивом", " именительный падеж с инфинитивом", "For + сущ. (местоимение) + инфинитив".

Часть 1 Лексика

Задание № 1. Переведите словосочетания на русский язык.

withdrawals which are not passed on as spending as UK firms; job security ; generations placed great store by saving; will remove those funds from the domestic circular flow and will cause a decrease; the tax revenue.

Задание № 2. Замените слова, выделенные курсивом синонимами

decisions are taken in response to economic uncertainty; consume durable goods; will cause a decrease on the level of economic activity; earnings from export have been insufficient.

Задание № 3. Найдите в тексте английские эквиваленты следующих словосочетаний.

доходы от сбережений; в конце концов; на том основании; налог на добавленную стоимость; акцизный сбор; восполнять.

Задание № 4. Вставьте вместо пропусков подходящие по смыслу слова.

Переписка по вопросам поставки запасных частей.

suit technology produced contract started advantages consider

deliver

Dear Sirs,

This is to advise you that we will no longer be able to …… you spare parts № 0376.The point is that these spare parts are no longer…… . The manufacturing plant has …….the production of a more updated type which is in full conformity with the latest…… .

The spare parts to be supplied in the future have a number of……. . One of them is the fact that the offered model is more reliable in operation.

We ask you to…… our offer and if you have any remarks we will be ready to discuss them.

We hope that our proposal will ……you. We will adjust the cost of the spare parts under the present ……on the basis mutually agreed upon.

Yours faithfully.

Часть 2 Грамматика

Задание № 1. Вставьте вместо пропусков модальные глаголы. Предложения переведите на русский язык.

-

When he was in a business trip he…….. solve this question.

a) had to b) could c) must

-

Your department……… have fulfilled this work in time.

a) must b) might c) could

-

The steamer……. arrive tomorrow morning.

a) must b) may c) has to

Задание № 2. Переведите предложения с русского на английский язык.

-

Нам надо будет зафрахтовать еще один пароход.

-

Я должен встретиться с представителем фирмы Intell.

-

Вам следует отослать письмо сегодня.

Задание № 3. Напишите следующие предложения в прошедшем и будущем времени.

-

We can discuss prices

-

The agent must be at work at 9 a. m.

Задание № 4. Переведите следующие предложения на русский язык. Определите формы и функции инфинитива.

-

I will give them control over the company, not to develop production but to eliminate all competition in the Russian market.

-

The town will go into decline, there will be less competition to help raise standards.

Задание № 5. Переведите следующие предложения на английский язык.

-

Я хочу, чтобы вы пошли в офис и поговорили с директором.

-

Очень трудно разработать новый вид товара в короткий срок.

-

Кажется, он взял кредит в банке.

-

Он просил показать ему образцы товаров

Часть 3.

Прочитайте и переведите текст. Выполните письменный перевод отмеченных абзацев.

Письменно ответьте на вопросы.

WITHDRAWALS

Withdrawals (or leakages) are that part of the circular flow, which are not passed on as spending with UK firms. This is income, which individuals, firms or governments take out of the circular flow with the likely result that the level of economic activity in the economy declines. The three forms that withdrawals can take are:

-

Savings

-

Imports

-

Taxation

Savings.

Both businesses and individual citizens can take the decision not to spend all of the income that they receive. A number of factors are thought to determine the level of savings at any one time. Interest rates obviously influence the saver's decision since they represent the return on his or her savings. Many economists believe that decisions to save are taken in response to periods of economic uncertainty: the more worried people are about interest rates, job security and so on, the more they are likely to save. Alternatively, there is evidence that when money is losing value quickly, as in a period of inflation, people tend to purchase consumer durable goods such as televisions and washing machines.

Another factor is social change. Previous generations placed great store by saving in order to carry out major purchases; this is less common today perhaps due to the ready availability of credit.

Imports.

You will know that expenditure by UK inhabitants on goods and services imported from abroad -will remove those funds from the domestic circular flow and will cause a decrease in the level of economic activity. Periodically, the UK has spent too freely on imports and earnings from exports have been insufficient to cover this. Many factors encourage us to purchase imports: some are favourable to the economy in the long term, whilst others are harmful. If imports of raw materials increase due to the growth of a domestic industry, then this indicates an expanding economy, which should sell more exports in the future in order to pay for the increased expenditure. However, if the imports are the consequence of UK citizens preferring foreign goods on grounds of, for example, price or quality, then the impact may be harmful as jobs are lost in domestic industries.

Answer the questions:

1. What are withdrawals? Name their forms.

2. When do people decide to save?

3. What is the reason for purchasing imports?

4. Why can buying imports be harmful?

5. What are direct and indirect taxes?

6. Why did the Conservative government reduce direct taxes in the 1980s and increase indirect ones?

КОНТРОЛЬНАЯ РАБОТА

Вариант 9

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов".

Грамматика: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: " Герундий", " Причастие".

Часть 1 Лексика

I. Дайте русские эквиваленты английским словосочетаниям:

inflation varies considerably in its extent and severity; mild inflation of a few%; rate of inflation; insurmountable problems: demand-pull inflation

II.Замените слова, выделенные курсивом синонимами

a persistent rise; hence; may pose few difficulties; at length; inflation occurs when; firms face increasing costs; owing to trade union militancy

III. Найдите в тексте английские эквиваленты следующих словосочетаний:

повышение спроса (покупательной способности); гиперинфляция; запросы опережают возможности экономики; предложить товары и услуги

IV. Вставьте вместо пропусков подходящие по смыслу слова:

1. No matter how much work a man can do, no matter how engaging his personality may be, he will not _____ far in business if he cannot ______ through others. ( advance, run, work, rest )

2. A good idea that is not shared with others will gradually fade away and bare no _____, but when it is shared it lives forever because it is passed on from one _____ to another and grows as it goes. ( fruit, sweets, person, director)

3. Every young man would do well to remember that all successful business_____ on the foundation of _____.

( stands, hangs, morality, money)

Часть 2 Грамматика

-

Допишите предложения, употребляя герундий.

I couldn't help………… .

I am tired of ………….. .

He left the room without ………. .

2. Замените придаточные предложения оборотами с герундием, поставив, где требуется , соответствующий предлог.

1. When I received a telegram, I started home at once.

2. You may avoid many mistakes if you consult the specialist.

3. When he entered the room he greeted everybody.

3. Переведите предложения на русский язык, укажите форму причастия и определите, в какой функции оно употреблено:

1. The article on agriculture published in this magazine was written by me.

2. While examining the cases discharged from the ship, he noticed that some of them were broken.

3. The man speaking over the telephone is the manager of this firm.

4. Переведите предложения с русского на английский язык.

1. Я еще не просмотрел всех каталогов, присланных нам из Англии.

2. Машины, заказанные на московском заводе, прибудут через несколько дней.

3. Машинистка уже напечатала все письма, написанные менеджером.

5. Напишите заключительную часть делового письма:

Dear Mr. Nikitin:

Mr. P. Brown, Managing Director of SNOW AND ICE INTERNATIONAL, and I are planning a small dinner party in honor of John White, Chairman of the Board and James Green, Executive Vice President and Chief Financial Officer of the American ICE AND SNOW COMPANY. The dinner will be held at the INTERICE INN, Los Angeles, beginning at 7.30 p.m. for 8.00 p.m. on Friday, June 25, and dress will be informal business attire.

……………………

With warm regards,

Simon Snow

Manager

Часть 3

Текст

Прочитайте и переведите текст. Дайте письменный перевод абзацев: "Demand-pull Inflation, Cost-push Inflation".

INFLATION

Inflation is generally defined as a persistent rise in the general price level with no corresponding rise in output, which leads to a corresponding fall in the purchasing power of money.

In this section we shall look briefly at the problems that inflation causes for business and consider whether there are any potential benefits for an enterprise from an inflationary period.

Inflation varies considerably in its extent and severity. Hence, the consequences for the business community differ according to circumstances. Mild inflation of a few per cent each year may pose few difficulties for business. However, hyperinflation, which entails enormously high rates of inflation, can create almost insurmountable problems for the government, business, consumers and workers. In post-war Hungary, the cost of living was published each day and workers were paid daily so as to avoid the value of their earnings falling. Businesses would have experienced great difficulty in costing and pricing their production while the incentive for people to save would have been removed.

Economists argue at length about the causes of, and "cures" for, inflation. They would, however, recognize that two general types of inflation exist:

* Demand-pull inflation

* Cost-push Inflation

Demand-pull Inflation.

Demand-pull inflation occurs when demand for a nation's goods and services outstrips that nation's ability to supply these goods and services. This causes prices to rise generally as a means of limiting demand to the available supply.

An alternative way that we can look at this type of inflation is to say that it occurs when injections exceed withdrawals and the economy is already stretched (i.e. little available labour or factory space) and there is little scope to increase further its level of activity.

Cost-push Inflation.

Alternatively, inflation can be of the cost-push

variety. This takes place when firms face increasing costs. This

could be caused by an increase in wages owing to trade union

militancy, the rising costs of imported raw materials and

components or companies pushing up prices in order to improve their

profit ">

КОНТРОЛЬНАЯ РАБОТА

Вариант 10

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов".

Грамматика: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: " Герундий", " Причастие".

Часть 1 Лексика

I. Дайте русские эквиваленты английским словосочетаниям:

a steady rise in money profits produces favourable expectations; this cost will be falling in real terms; this viewpoint has gained in credence in government circles.

II.Замените слова, выделенные курсивом синонимами

a steady rise in money profits induces investment as firms seek to expand; rates are not considered to be ...; the conclusion must be drawn

III. Найдите в тексте английские эквиваленты следующих словосочетаний:

стимулировать капиталовложения; устанавливать цену; брать взаймы крупные суммы; настаивать, утверждать

IV. Вставьте вместо пропусков подходящие по смыслу слова:

-

Bank: an institution where you can _____ money if you can present sufficient evidence that you don't_____ it.

( borrow, steal, need, have)

2. Whatever you have, you must either____ or ____. (use, buy, lose, sell )

3. You cannot climb the _____ of success with your ____ in your pockets. ( ladder, building, hands, head )

Часть 2 Грамматика

-

Допишите предложения, употребляя герундий.

At last we succeeded in ……… .

She was prevented from ……. .

You should avoid ………. .

2. Замените придаточные предложения оборотами с герундием, поставив, где требуется , соответствующий предлог.

1. After they had sat there a few minutes, they continued their journey.

2. While the typist was copying the text, she made a few mistakes.

3. I am thankful that I have been stopped in time.

3. Переведите предложения на русский язык, укажите форму причастия и определите, в какой функции оно употреблено:

1. What do you call a ship built for the transportation of timber?

2. You can get the book recommended by our tutor in the library.

3. He asked her to go on with her story, promising not to interrupt her again.

4. Переведите предложения с русского на английский язык.

1. Все студенты, принимающие участие в этой работе, должны прийти в университет сегодня в 3 часа.

2. Имея много времени, он пошел на вокзал пешком.

3. Переходя через мост, я встретил менеджера по продажам фирмы DIOS.

5. Напишите заключительную часть делового письма:

Dear Mrs. Rain:

Mr. Nikitin, Manager of EXPORTSNOW, thanks you very much for the invitation to a dinner party at the INTERICE INN on July 25, in honor of the senior management of the American ICE AND SNOW COMPANY.

……………………………………………..

Yours sincerely,

Secretary to Mr. S. Nikitin.

Часть 3 Текст

Прочитайте и переведите текст. Дайте письменный перевод 2 и 3 абзацев.

CAN INFLATION BE BENEFICIAL

We would be simplifying the impact of inflation on business if we suggested that all effects were unfavourable. There is a school of thought, which argues that a low and stable rate of increase in the price level can be beneficial. It believes that a steady rise in money profits produces favourable expectations and induces investment as firms seek to expand. This action expands the economy as a whole. Paradoxically, inflation can also reduce the costs of businesses in the short run. Many enterprises incur costs, which are fixed for some period of time - for example, the rent of a factory may be fixed at a particular figure for a few years. At a time when the selling price of the firm's product, and hence its sales income, is rising this cost will be falling in real terms and thus stimulating the business.

There is a further argument that firms may be persuaded to borrow heavily in a period of inflation since the burden of repaying loans is reduced by inflation. If inflation is running annually at 10 per cent, for example, then the real value of the repayments of the loan will fall by approximately that amount each year. This may serve to encourage investment which, since it is an injection into the circular flow, will promote the level of activity. However, in these circumstances interest rates are likely to be high.

Government will accept that low rates of inflation are likely to exist in many economies. Inflation rates of 5 per cent or below are not considered to be too great a problem, especially if competitor nations are suffering similar rates.

In spite of the above, the conclusion must be drawn that inflation is, in general, harmful to business and its environment. Indeed, many economists would contend that inflation is the fundamental evil as its presence leads to lack of competitiveness and therefore relatively high unemployment and low rates of growth. This viewpoint has gained in credence in government circles over the last few years. It is for this reason that its control has been a major objective of government economic policy throughout the 1980s and early 1990s.

КОНТРОЛЬНАЯ РАБОТА

Вариант 11

Прежде, чем приступить к выполнению контрольной работы, изучите материал учебника.

Лексика: И.И.Воронцова "Английский язык для студентов экономических факультетов".

Грамматика: К.Н.Качалова, Е.Е. Израилевич "Практическая грамматика Английского языка"

Разделы: " Герундий", " Причастие".

Часть 1 Лексика

I. Дайте русские эквиваленты английским словосочетаниям:

exchange labour services for money; a double coincidence of wants; spend a lot of time and effort; make mutually satisfactory swaps

II.Замените слова, выделенные курсивом синонимами

the vital feature of money; its purchasing power is worn away; the money is without value; time and effort are rare resources; private production of money is against the law

III. Найдите в тексте английские эквиваленты следующих словосочетаний:

средство платежа; средство обращения; мера стоимости; средство сбережения; обмениваться товарами и услугами;

покупательная способность

IV. Вставьте вместо пропусков подходящие по смыслу слова:

1.Business is always _____ with pleasure - but it ____ other pleasures possible. ( interfering, receiving, makes, shows)

2. Wealth is not only what you _____ but it is also what you ___ . (have, buy, are, must)

3. To my mind the best investment a young man starting out in business could possibly make is to ____ all his time , all his ____ to work , just plane , hard work. ( give, idle, energies , money)

Часть 2 Грамматика

-

Допишите предложения, употребляя герундий.

He read the report before……….. .

She has no intention of ………… .

He started ………….. .

2. Замените придаточные предложения оборотами с герундием, поставив, где требуется , соответствующий предлог.

1. I remember that I have read this article.

2. I don't remember that I have ever come across his name before.

3. You can improve your knowledge of economics if you read more.

3. Переведите предложения на русский язык, укажите форму причастия и определите, в какой функции оно употреблено:

1. Not receiving any documents from the firm SUNRISE, she sent them a telegram.

2. The textile goods produced by the factory are in great demand.

3. He left the office at three o'clock, saying he would be back at five.

4. Переведите предложения с русского на английский язык.

1. Мы долго сидели в кабинете, разговаривая о предстоящей поездке.

2. В его статье есть много цифр, иллюстрирующих развитие нашей промышленности.

3. Он показал нам список товаров, экспортируемых этой фирмой.

4. Напишите заключительную часть делового письма:

Gentlemen:

In reply to your advertisement in today's "Moscow Magazine", I am interesting in becoming a salesman for your company.